- #Progress billing in quickbooks desktop how to#

- #Progress billing in quickbooks desktop full#

- #Progress billing in quickbooks desktop free#

For example, if I have quantity 1 of a product and I invoice the customer for.

#Progress billing in quickbooks desktop how to#

I do not understand how to properly track my inventory if a customer is paying off a bill in partial payments. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. I am new to progress invoicing and inventory tracking. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. We provide third-party links as a convenience and for informational purposes only. Readers should verify statements before relying on them.

#Progress billing in quickbooks desktop free#

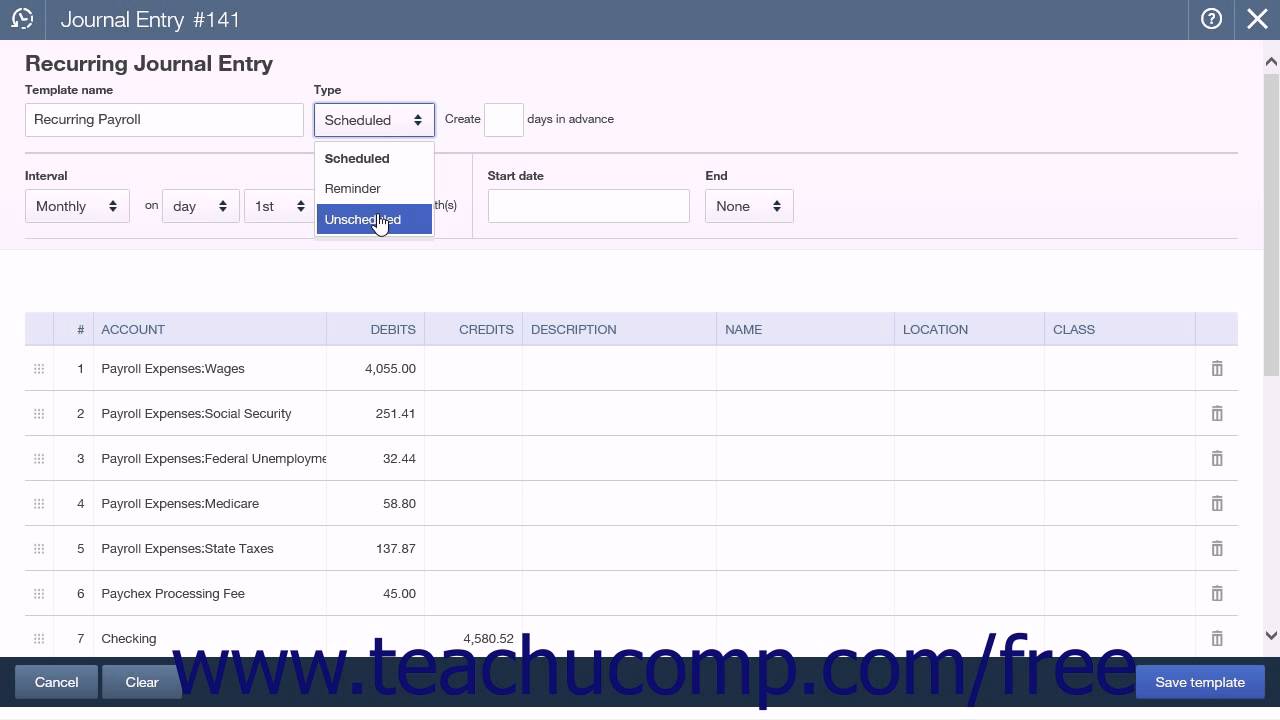

does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Progress billing is typically used for large, long-term projects, and it helps contractors maintain an adequate level of funding throughout the duration of the project. Accordingly, the information provided should not be relied upon as a substitute for independent research. What Is Progress Billing Progress billing is the process of incrementally invoicing clients for a project. does not have any responsibility for updating or revising any information presented herein. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Applicable laws may vary by state or locality. Additional information and exceptions may apply. Here's a link to reach them: Contact QuickBooks Desktop support.This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. You can also contact our Customer Care Team within support hours if you need more help in locating your backup file. Once you've found the recent backup file, you can restore it and review the recorded transactions: Restore a backup of your company file. You can follow the steps in this article to locate the most recent backup file: Company file is missing or cannot be found. How to record work in progress in QuickBooks - Quora Answer: Work in Progress - General Contractor - Construction - Set up and send progress invoices in QuickBooks Desktop If you haven't already, turn on progress invoicing. We have two ways to get the payments back. If there is no history that the payment was created or the company file is damaged, there's a possibility that you have opened a backup file that doesn't include the recorded payments.

Also, the Verify and Rebuild process will verify the condition of your company file. The Audit Trail report should be able to tell us whether the payment was deleted or not. Tag me in your reply and I’ll get back to you as soon as I can. I’ll be around if you have other follow-up questions about your progress invoice.

#Progress billing in quickbooks desktop full#

Yes, you can invoice the full amount of the estimate when you select the progress invoice. This can walk you through the steps on how to access your reports outside QBDT Best Answers ChristieAnn QuickBooks Team Septem09:01 AM Hi there, debbie011. You can also utilize this report as future guidance: Export reports as Excel workbooks in QuickBooks Desktop. This will show you how much you invoice for each estimate. To track your progress invoices efficiently, I suggest running the Job Progress Invoice vs. This identifies and resolves most data issues in your company y file. However, if there are no changes made, I recommend running the Verify and Rebuild utility tool. If they were edited, click on it and enter the correct information. If the transactions were deleted, click on it and Create a copy. You can also click the Customize Report button at the top bar and personalize the report to show the date you need.Select the Audit Trail report and click Run to view it.Let’s run the Audit Trail report and check who made those changes in your company file. Thus, it doesn’t show in your progress billing invoices. There’s a possibility those priors payments were deleted or edited. I got some steps we can perform to get to the bottom of this. Greetings, here to help you look for those amounts in your QuickBooks Desktop (QBDT) software.

0 kommentar(er)

0 kommentar(er)